株主・投資家情報

INVESTOR RELATIONS

IR情報メニュー

最新IR資料ダウンロード

最新のIR資料を一括でダウンロードできます。

データ内容

決算短信、決算説明資料、決算説明会資料、有価証券報告書

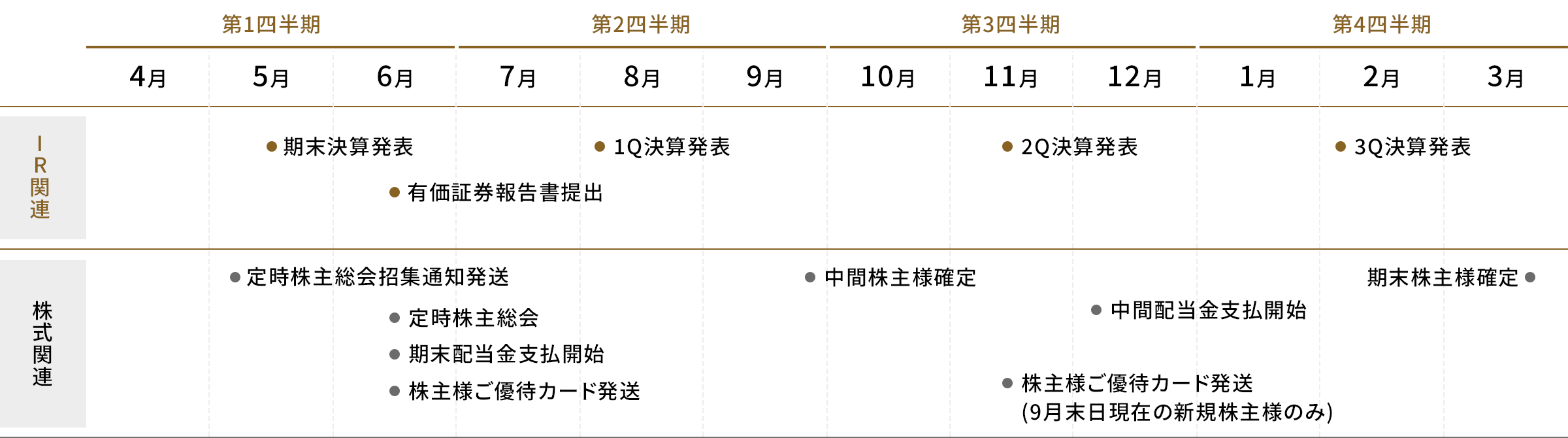

IRカレンダー

こちらの図は左右にスワイプしてご覧ください

アクセスランキング

免責事項

- 掲載する情報について

当社ホームページに掲載する情報について、当社は細心の注意を払っておりますが、情報の正確性及び完全性について保証するものではなく、情報に誤りがあった場合や、第三者によるデータの改ざん、データダウンロード等によって生じる如何なる障害・損害についても、当社は一切責任を負うものではありません。なお、当社ホームページへの情報掲載は、投資勧誘を目的とするものではありません。投資に関するご決定は、ご利用者様ご自身のご判断において行われるようお願いいたします。 - 将来の見通しについて

当社ホームページに掲載する情報には、将来の業績の見通しに関する記述が含まれる場合があります。この記述は、将来の業績を保証するものではなく、様々なリスクや不確実性を含んでおります。従いまして、経済情勢や市場動向の変化等によって、実際の業績が見通しとは異なる可能性があることにご留意ください。 - 当社ホームページの運用について

当社ホームページは、予告なく、運営の中断や中止、内容の変更を行うことがあります。また、通信環境やご利用者様のコンピュータ、ソフトウェア等の状況、その他の理由により当社ホームページを正常にご利用いただけない場合があります。これらによって、ご利用者様に生じた如何なるトラブル・損害についても、当社は一切責任を負うものではありません。